HOTSPOT -

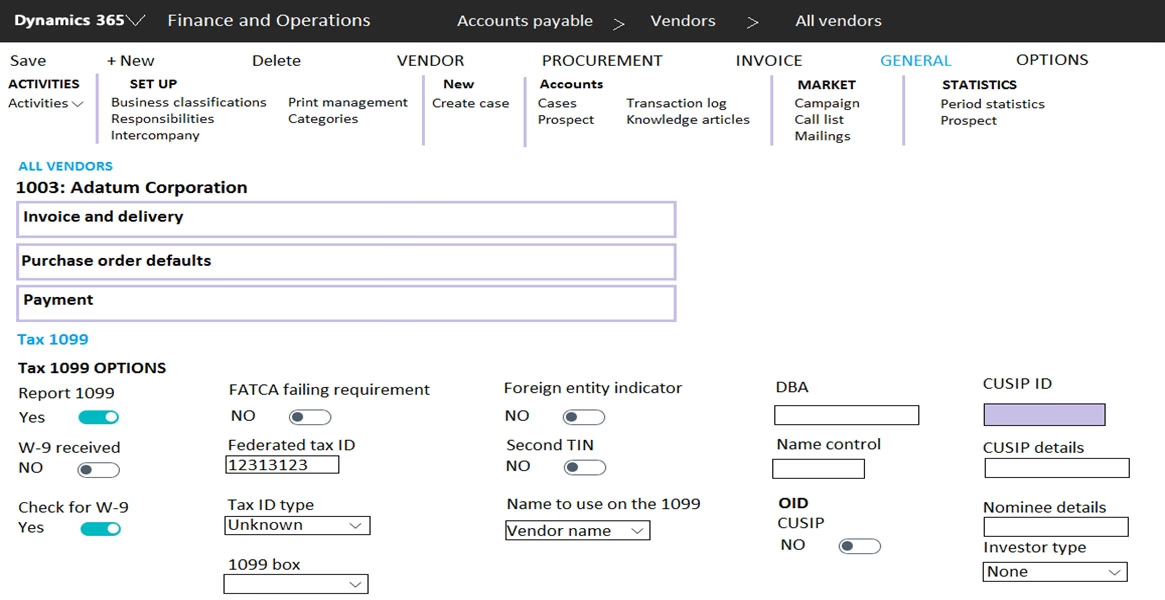

A client plans to use Dynamics 365 Finance for year-end 1099 reporting in the United States.

You are viewing a vendor master data record on the 1099 FastTab.

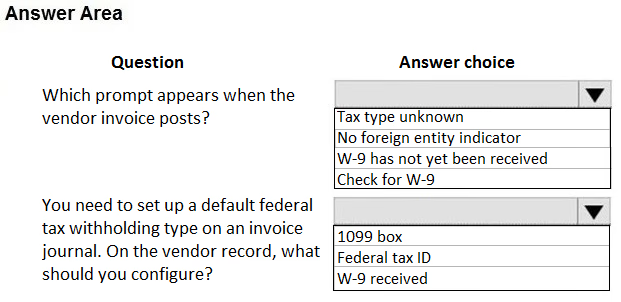

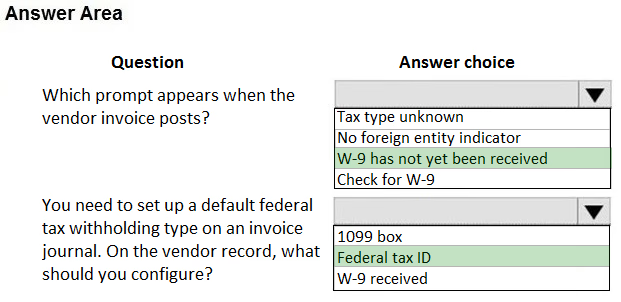

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Hot Area: