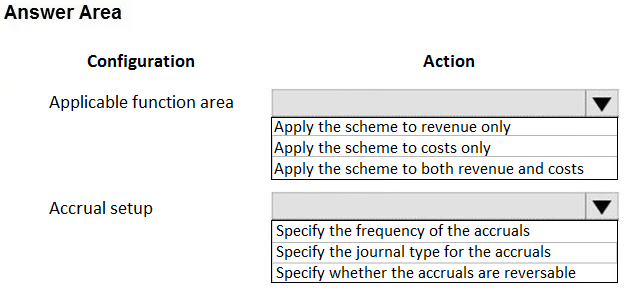

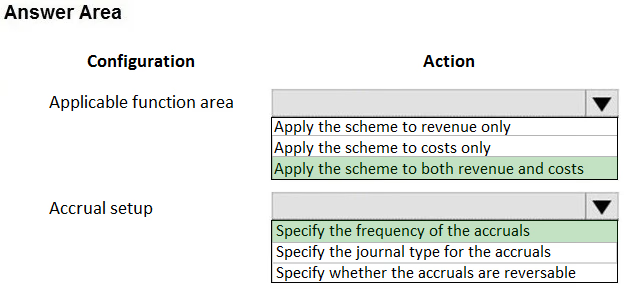

HOTSPOT -

A rental service company hires you to configure their system to implement accrual schemes.

You need to configure the accrual schemes for the company for both rentals and associated expenses.

Which configuration and transaction options should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area: