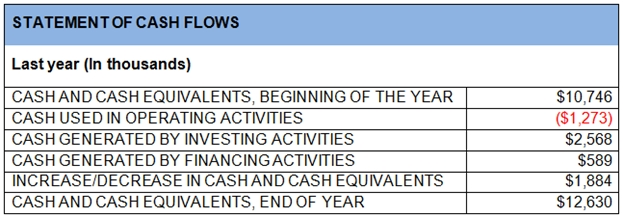

The table illustrates the statement of cash flows for a courier company for the last fiscal year.

Due to aggressive market competition, the management of the company performed a strategy review and based on their findings and the current market conditions they came up with strategic and tactical changes in order to keep a competitive market position.

In order to strengthen customer retention strategies through a new competitive advantage, the company is considering implementing a live parcel tracking system.

The added value will be that the customers may determine the exact location of the parcel whether it is in a warehouse, crossing the ocean through an overseas ship, or travelling in a delivery truck at any time. The system tracks the location of the parcel by tracking the vehicle in which it is contained. However, for a group of old delivery trucks, it was noticed that the engine sound and vibration disturbed the tracking signal and caused interruptions. Therefore, the tracking does not perform accurately on these vehicles. Although the majority of management would like to sell these vehicles and replace them with newer ones, the Chief

Financial Officer (CFO) was strongly against that approach. The CFO argued that instead of hanging tracking devices on the trucks' body, they can have the truck drivers manually send the truck location from a hand held mobile device every 30 minutes.

The company has a total of 134 old delivery trucks that have been in service for 10 years. Each vehicle was bought at a price of $22,000. Depreciation is done using a straight line basis and it is estimated that the vehicle depreciates at $1000 per year. The estimated salvage value per vehicle is about $3,000.

Another area of tactical improvement for the courier company is pricing. The management strongly believes that they can start a price war with the most aggressive competitor. Management thinks, with their variable cost of $4 per parcel and fixed cost of $6 per parcel, they can win the market. However, after implementing the tracking solution, fixed cost will jump to $8 per parcel which made management reconsider their options. The competitor has variable costs of $5 per parcel and fixed costs o $7 per parcel.

The CFO's resistance to replacing the older vehicles represents which type of cost?