An insurance company wants to increase sales by 15% and customer retention by 10% within 1 calendar year. Various strategies to achieve this were considered and a restructure to the existing pricing model is selected to help achieve these goals.

A business analyst (BA) works with stakeholders such as actuaries, product specialists, sales staff, risk managers, and underwriters who agree to applying varying levels of discounts to customers based on:

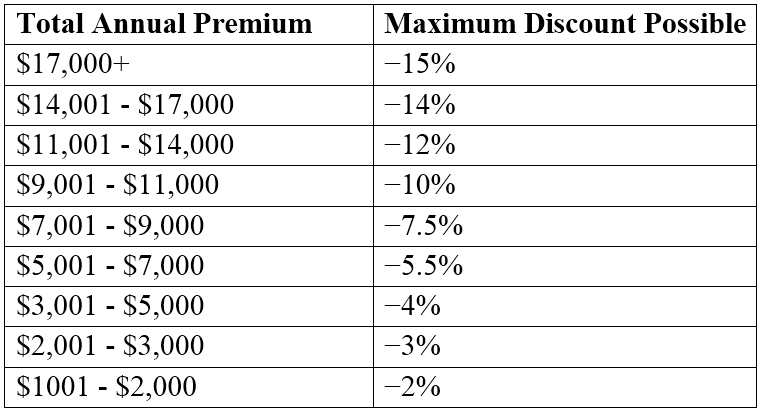

"¢ Total annual premium the customer has with the company (Financial worth)

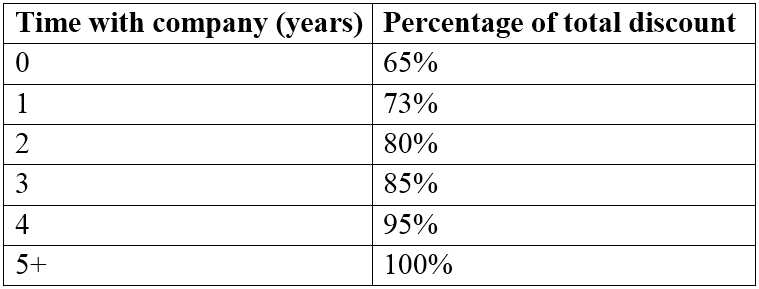

"¢ Time with the insurance company (Loyalty)

Various financial models are considered but the stakeholders agree that an initial applicable discount is determined based on the customer's overall premium:

The percentage of the maximum possible discount available to the customer is adjusted based on time with the company:

As the new pricing structure was being implemented, the chief executive officer (CEO) of the company wanted to change the premiums and associated discounts offered to customers. The BA investigated the cost, anticipated benefits and the length of time the change would likely take to complete before presenting the results back to the CEO.

What type of analysis has the BA just conducted?