A large insurance company wants to buy a new claims processing system or upgrade one of its two existing systems. Each year the claims department is given a

$3,5 million budget to spend. Time is of the essence since there are some regulatory changes that will be coming the following year that will require several features that currently neither one of the two claims systems currently support.

There are eight stakeholders involved in this initiative. There are local to where the claim systems are managed, while five are located across the country. The business analyst (BA) struggled to get all stakeholders to agree on the desired features but ultimately got agreement on ten identified key features for the new claims systems. The BA was able to build a current state and future state process model which included all ten key features.

System A processes 75% of the company's claims. It is 5 years old and the claim processors love it because it is easy to use. However it must go offline for two hours each day. The code is very modular so it does have flexibility to be modified. To upgrade system A to have all ten features it would cost %5 million. System

A would be at capacity if it were to process all of the company's claims.

System B processes 25% of the company's claims. It is an older mainframe system, but rarely goes offline. It could easily handle double the number of claims that system A processes. However, it has a lot of legacy code and would cost $6 million to upgrade.

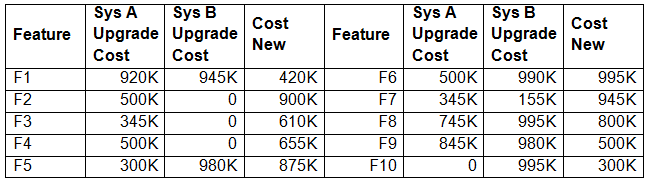

Both systems have some of the ten desired key features. But neither system has all ten. The cost to buy a new system would be $7 million.

Below is the estimated cost for each feature in priority order.

If the budget for the initiative was firm, what is a feasible solution to make sure the project stays within budget?