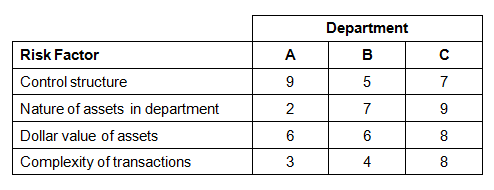

A bank uses a risk analysis matrix to quantify the relative risk of auditable entities. The analysis involves rating auditable entities on risk factors using a scale of 1 to 10, with 10 representing the greatest risk. A partial list of risk factors and the ratings given to three of the bank's departments is provided below:

Which of the following statements regarding risk in the department is true?