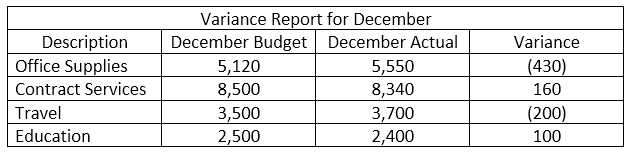

As the HIM manager in charge of your department's budget, you are mandated to report on variances of more than 6% either positive or negative to your Chief

Financial Officer and include the reasons for the variance and any action plans necessary. Based on the table below for the December variance report, what category would you be required to report on to the CFO?