Tax rates charged on sales orders need to be calculated based on locality and region.

You need to recommend a cost-effective solution that can be implemented quickly.

What should you recommend?

The most cost-effective and quickly implementable solution for calculating tax rates based on locality and region would be to check AppSource for a tax add-on. AppSource is a marketplace provided by Microsoft where you can find and deploy various third-party tax calculation add-ons that are specifically designed for this purpose. These add-ons can be easily integrated into existing systems like Dynamics 365 Finance, saving considerable time and development effort compared to creating custom solutions or maintaining tax tables manually.

Community votes

No votes yet

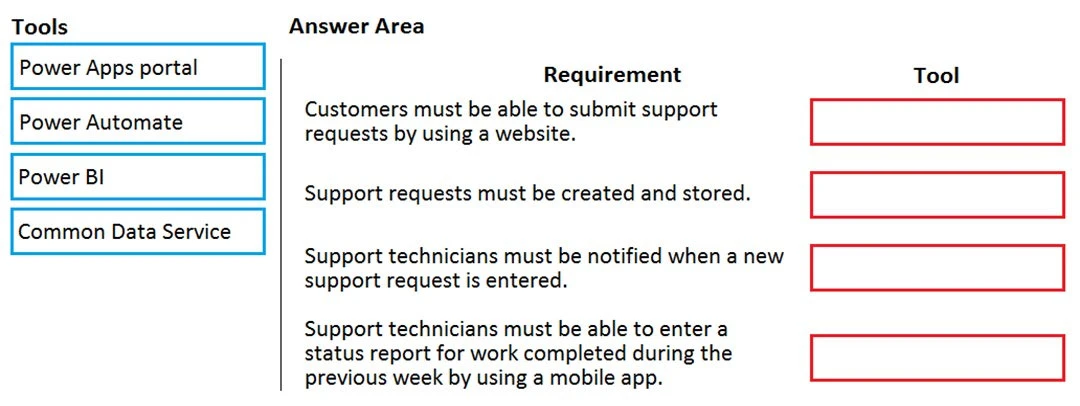

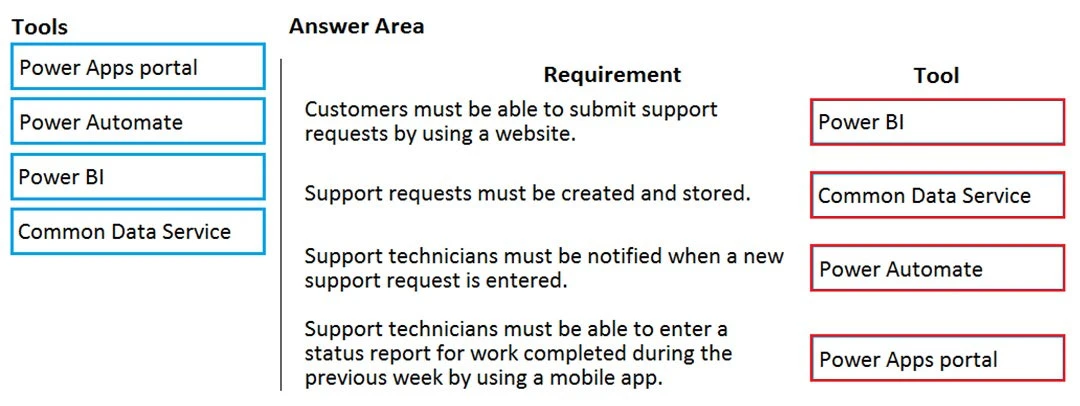

You manage the support team at a rapidly growing company.

Customers and support technicians need a better experience when logging and responding to support requests. You need more visibility into what the support technicians are doing every week.

You need to recommend tools to help the company's needs.

Which tools should you recommend? To answer, drag the appropriate tools to the correct requirements. Each tool may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Community votes

No votes yet

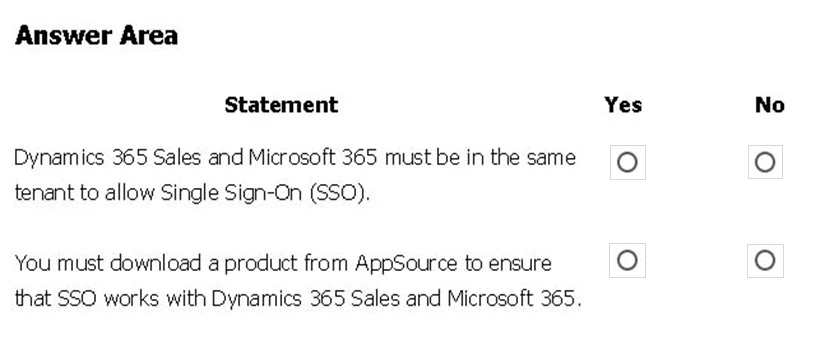

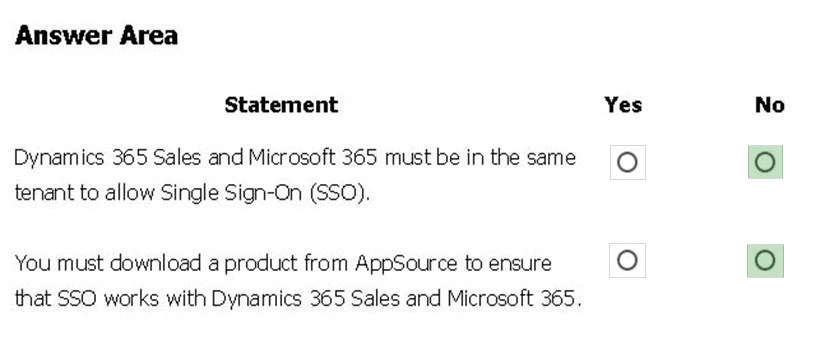

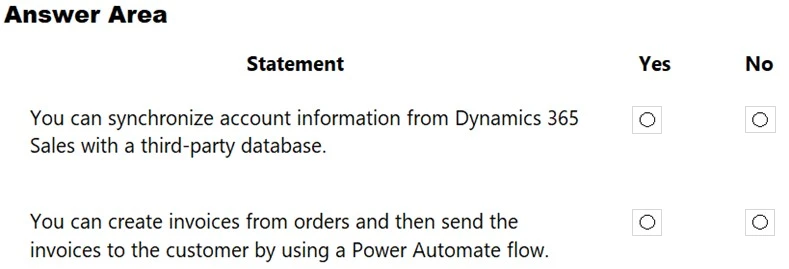

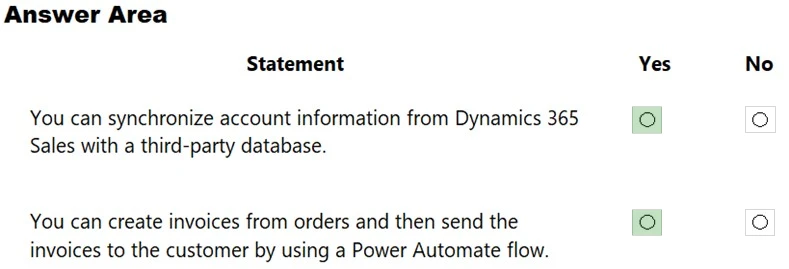

You are building Power Apps apps that use both Dynamics 365 Sales and Microsoft 365.

For each of the following statements, select Yes if the statement is true. Otherwise, select No.

NOTE: Each correct selection is worth one point.

Hot Area:

When you offer your application for use by other companies through a purchase or subscription, you make your application available to customers within their own

Azure tenants. This is known as creating a multi-tenant application.

Box 2: No -

Reference:

https://docs.microsoft.com/en-us/azure/active-directory/manage-apps/isv-sso-content

Community votes

No votes yet

Which three Microsoft products are part of the Power platform? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

The Microsoft Power Platform consists of Power Apps, Power Automate, and Power BI. Power Apps is a suite of apps, services, and connectors, as well as a data platform, that provides a rapid application development environment to build custom apps for your business needs. Power Automate, formerly known as Microsoft Flow, allows users to create automated workflows between applications and services to synchronize files, get notifications, collect data, and more. Power BI is a business analytics service that delivers insights to enable fast, informed decisions. These three products are integral components of the Power Platform and work together to empower users to analyze data, build solutions, automate processes, and create virtual agents. Azure Active Directory and Azure Machine Learning are not part of the Power Platform.

Community votes

No votes yet

A company plans to implement Power Platform apps. The company does not plan to use any development tools or plug-ins.

Which actions can you perform?

For each of the following statements, select Yes if the statement is true. Otherwise, select No.

NOTE: Each correct selection is worth one point.

Hot Area:

Reference:

https://docs.microsoft.com/en-us/learn/powerplatform/

Community votes

No votes yet