You need to implement posting definitions.

In which situation should you implement posting definitions?

You need to set up fiscal calendars for Dynamics 365 Finance.

What are three uses for fiscal calendars? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

You need to import electronic bank statements to reconcile the bank accounts.

Which three actions can you perform? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

The allocation rule must meet the following requirements:

✑ Distribute overhead utility expense to each department.

✑ Define how and in what proportion the source amounts must be distributed on various destination lines.

You need to configure the allocation rule.

Which allocation method should you use?

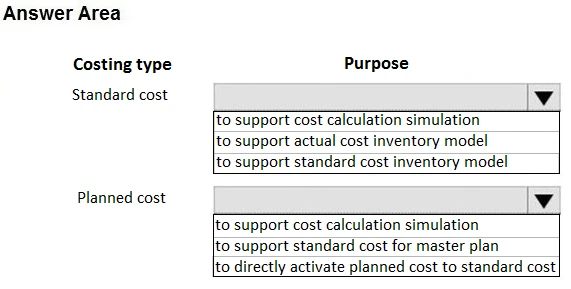

A food manufacturer uses commodities such as beans, corn, and chili peppers as raw materials. The prices of the commodities fluctuate frequently. The manufacturer wants to use cost versions to simulate these fluctuations.

You need to set up cost versions and prices to accomplish the manufacturer's goal.

For which purpose should you use each costing type? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area: