Which of the following should be done during research and interpreting regulations Compliance professionals in mitigating compliance risk?

To effectively mitigate compliance risk, compliance professionals must conduct thorough research and accurately interpret regulations. Key aspects include tracking regulatory proposals to stay informed about potential changes, implementing final regulatory rules to ensure adherence, and understanding the business units' operating environment and risk tolerance to tailor compliance strategies appropriately. This comprehensive approach helps in anticipating, preparing for, and complying with regulatory requirements, thereby mitigating compliance risks effectively.

The compliance program should address plans to verify adherence to applicable regulations through:

The compliance program should address plans to verify adherence to applicable regulations through a combination of ongoing monitoring to evaluate the program, self-monitoring, and periodic reviews. This comprehensive approach ensures continuous oversight and the ability to identify and correct issues promptly, which strengthens the overall compliance framework.

There is no established template for documenting compliance risk. Each institution should develop a risk assessment that fits its risk profile. The components that are commonly used throughout the industry are as follows EXCEPT:

There is no established template for documenting compliance risk, each institution develops a risk assessment fitting its risk profile. Common components used throughout the industry include risk assessment, measuring key risk indicators, and identifying key performance indicators. Training the leadership of a compliance regulation program, while important, is not a standard industry component for documenting compliance risk.

In Compliance regulation and risk assessment key performance indicators usually include:

Key performance indicators in compliance regulation and risk assessment typically include metrics that directly relate to the financial and reputational consequences of non-compliance. Fines or penalties (A) directly measure financial repercussions of regulatory violations. Customer complaints (B) are a critical indicator of potential compliance issues, as they can flag problems that may require regulatory scrutiny. While regulatory criticism (C) can indeed be a key indicator, it is not inherently a performance metric as it is more a qualitative assessment than a quantifiable KPI. Therefore, options A and B are the most applicable KPIs in this context.

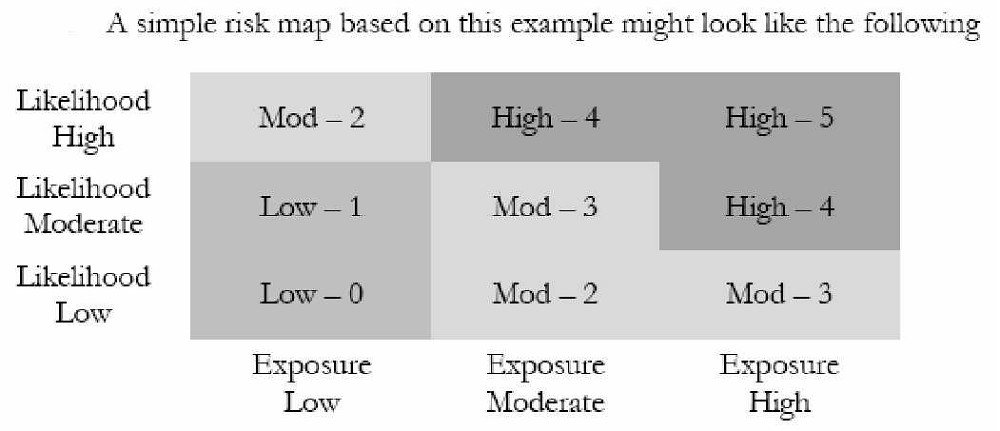

For example on a 0-5 scale:

The risk trend shows the direction of risk and probable change to risk over the next 12 months. A trend toward increasing risk means that

A trend toward increasing risk implies that the risk level is getting higher over time. As a result, management may need to take additional action to mitigate this growing risk, potentially through more controls, enhanced reviews, or other preventive measures. This is essential to ensure that the risk remains within acceptable limits set by the management's risk-tolerance level.