HOTSPOT -

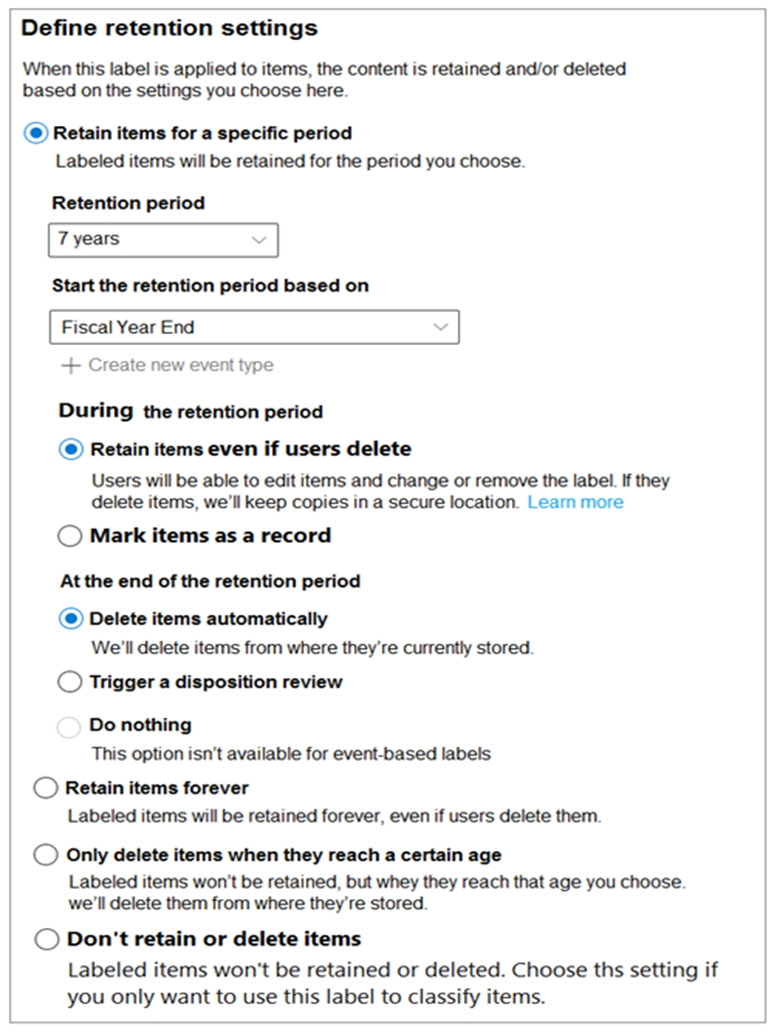

You have the retention label policy shown in the Policy exhibit. (Click the Policy tab.)

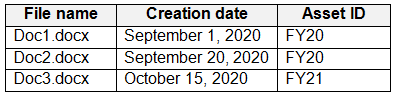

Users apply the retention label policy to files and set the asset ID as shown in the following table.

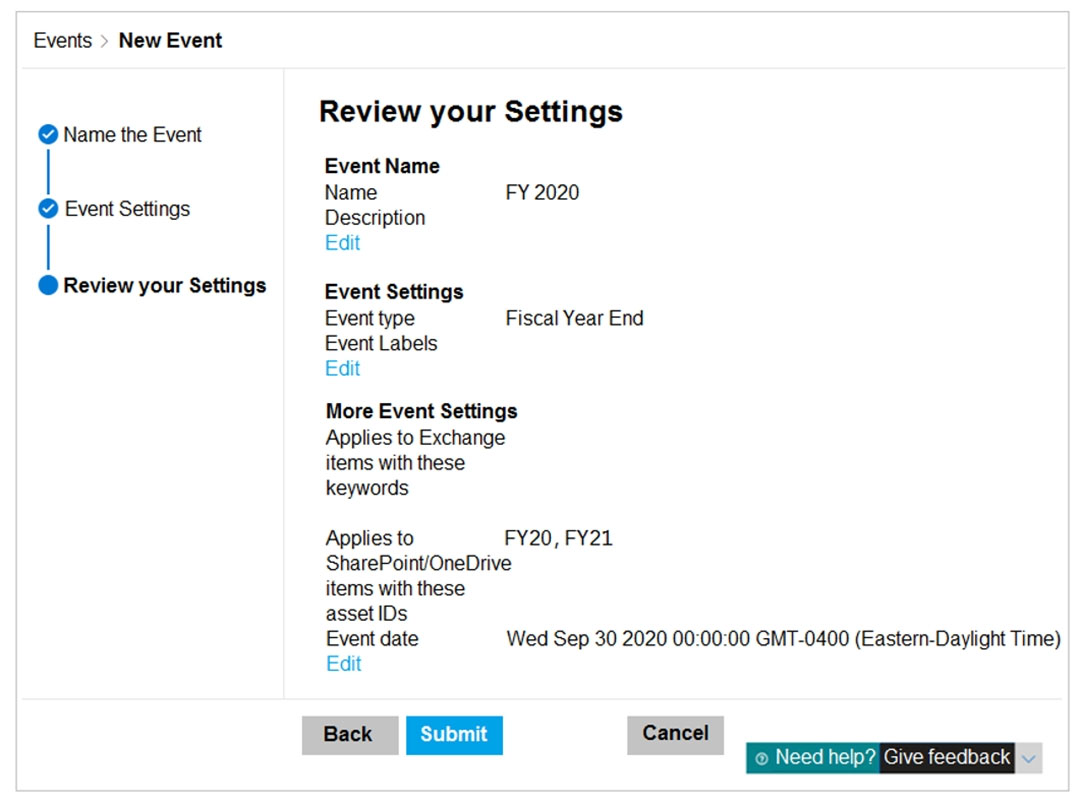

On December 1, 2020, you create the event shown in the Event exhibit. (Click the Event tab.)

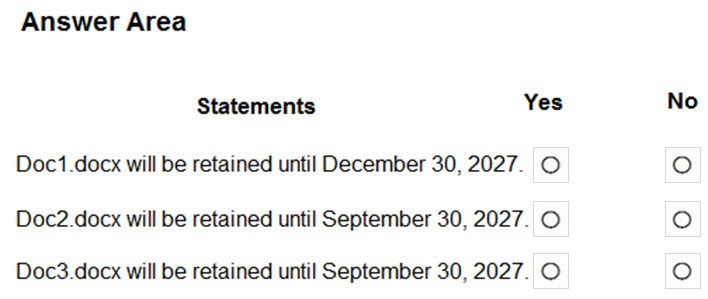

For each of the following statements, select Yes if the statement is true. Otherwise, select No.

NOTE: Each correct selection is worth one point.

Hot Area: